Page 37 of 117 Fileid: … ions/I1040/2018/A/XML/Cycle08/source 14:16 - 24-Jan-2019

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

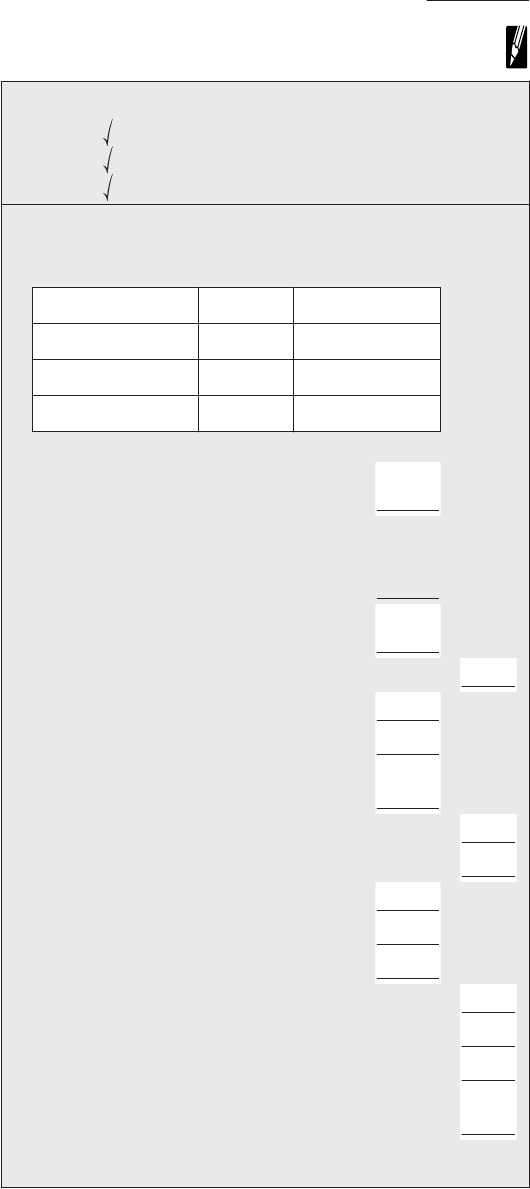

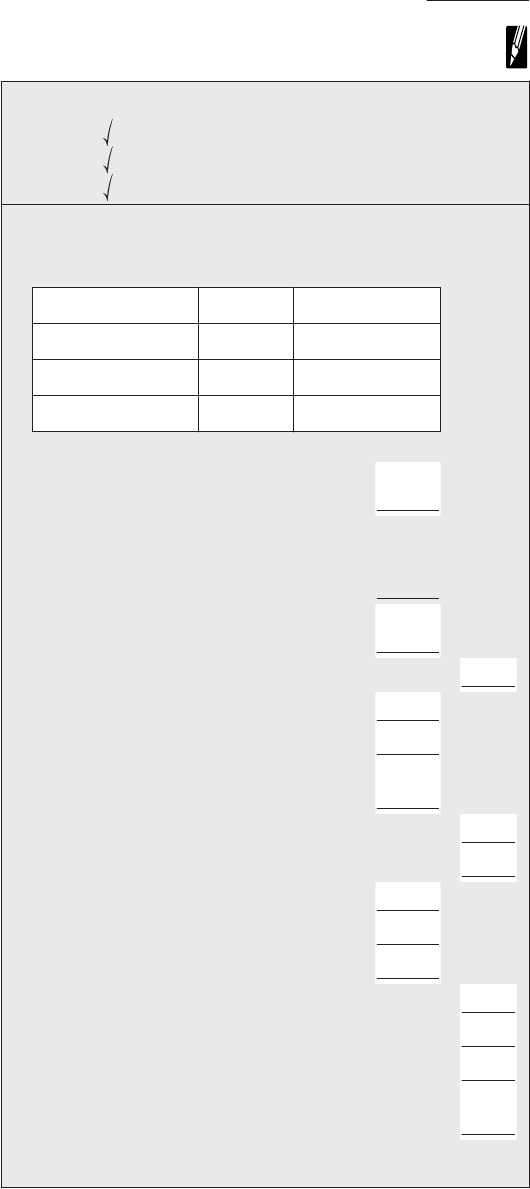

2018 Form 1040—Line 9

2018 Qualified Business Income Deduction—Simplified

Worksheet

Keep for Your Records

This worksheet is for taxpayers who:

Have qualified business income, REIT dividends, or PTP income.

Are not a patron in a specified agricultural or horticultural cooperative.

Have taxable income of $157,500 or less ($315,000 or less if married filing jointly).

Before you begin:

1. (a)

Trade or business name

(b)

Employer

identification number

(c)

Qualified business income or

(loss)

i.

ii.

iii.

iv.

2. Total qualified business income or (loss). Add the amounts in 1i through 1iv,

column 1(c) .......................................................... 2.

Note. If reporting qualified business income or (loss) from more than four

trades or businesses, see the instructions for line 2 of this worksheet.

3. Qualified business loss carryforward from the prior year ...................

3.

4. Total qualified business income. Combine lines 2 and 3. If zero or less,

enter -0- ........................................................... 4.

5. Qualified business income component. Multiply line 4 by 20% (0.20) .........................

5.

6. Qualified REIT dividends and PTP income or (loss) ........................

6.

7. Qualified REIT dividends and PTP loss carryforward from the prior year .......

7.

( )

8. Total qualified REIT dividends and PTP income. Add lines 6 and 7. If zero or

less, enter -0- ......................................................... 8.

9. REIT and PTP component. Multiply line 8 by 20% (0.20) ....................................

9.

10. Qualified business income deduction before the income limitation. Add lines 5 and 9 ............

10.

11. Taxable income before qualified business income deduction .................

11.

12. Net capital gain (see instructions) ........................................12.

13. Subtract line 12 from line 11. If zero or less, enter -0- .......................

13.

14. Income limitation. Multiply line 13 by 20% (0.20) ..........................................

14.

15. Qualified business income deduction. Enter the smaller of line 10 or line 14 ....................

15.

16. Total qualified business loss carryforward. Add lines 2 and 3. If more than zero, enter -0- .........

16.

( )

17. Total qualified REIT dividends and PTP loss carryforward. Add lines 6 and 7. If more than zero,

enter -0- ............................................................................. 17.

( )

-37-

Need more information or forms? Visit IRS.gov.